상위 6 가지 옵션 거래 전략 목록

- 롱 콜 옵션 거래 전략

- 콜 옵션 매도 트레이딩 전략

- 매수 풋 옵션 거래 전략

- 풋 옵션 매도 거래 전략

- 롱 스 트래들 옵션 거래 전략

- 숏 스 트래들 옵션 거래 전략

각각에 대해 자세히 논의하겠습니다.

# 1 롱 콜 옵션 거래 전략

- 이것은 주식이나 지수에 대해 매우 낙관적 인 공격적인 투자자를위한 옵션 거래 전략 중 하나입니다.

- 콜 구매는 제한된 하방 위험으로 상승 잠재력을 포착하는 훌륭한 방법이 될 수 있습니다.

- 모든 옵션 거래 전략 중 가장 기본적인 것입니다. 비교적 이해하기 쉬운 전략입니다.

- 당신이 매수할 때 그것은 당신이 주식이나 지수에 대해 낙관적이며 미래에 상승 할 것으로 기대한다는 것을 의미합니다.

| 사용하기 가장 좋은 시간 : | 주식이나 지수에 대해 매우 낙관적 일 때 . |

| 위험: | 위험은 프리미엄으로 제한됩니다. (시장이 옵션 행사 가격 이하로 만료되면 최대 손실이 있습니다). |

| 보상: | 보상은 무제한입니다 |

| 손익분기 점 : | (행사 가격 + 프리미엄) |

이제이 예제를 통해 웹 사이트에서 데이터를 가져 오는 방법과 롱 콜 전략에 대한 지불 일정을 결정하는 방법을 이해하겠습니다.

옵션 데이터를 다운로드하는 방법은 무엇입니까?

1 단계 : 증권 거래소 웹 사이트 방문

- //www.nseindia.com/으로 이동합니다.

- 주식 파생 상품 선택

- 검색 상자에 CNX Nifty를 입력합니다.

- 현재 Nifty 지수 가격은 오른쪽 상단 모서리에 있습니다. Excel 스프레드 시트에 기록해 둡니다.

- 이 예에서는 NSE (인도 국립 증권 거래소)를 사용했습니다. NYSE, LSE 등과 같은 다른 국제 증권 거래소에 대한 유사한 데이터 세트를 다운로드 할 수 있습니다.

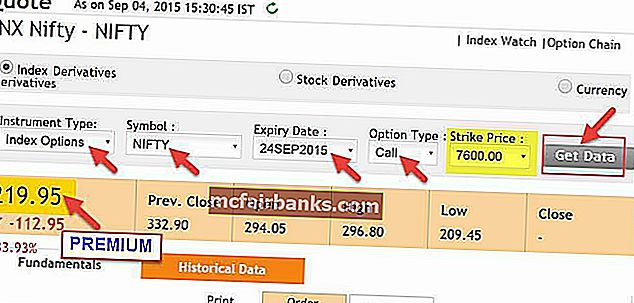

2 단계 : Option Premium 찾기

다음 단계는 프리미엄을 찾는 것입니다. 이를 위해 요구 사항에 따라 일부 데이터를 선택해야합니다.

따라서 Long Put 옵션 거래 전략의 경우 다음 데이터를 선택합니다.

따라서 Long Put 옵션 거래 전략의 경우 다음 데이터를 선택합니다.

- 기기 유형 : 인덱스 옵션

- 기호 : NIFTY

- 만료일 : 필요한 만료일을 선택합니다.

- 옵션 유형 : 콜 (추가 예를 들어 풋 옵션으로 풋을 선택합니다)

- 행사 가격 : 필요한 행사 가격을 선택합니다. 이 경우에는 7600을 선택했습니다.

- 모든 정보가 선택되면 데이터 가져 오기를 클릭 할 수 있습니다. 추가 계산에 필요한 프리미엄 가격이 표시됩니다.

3 단계 : Excel 스프레드 시트에 데이터 세트 채우기

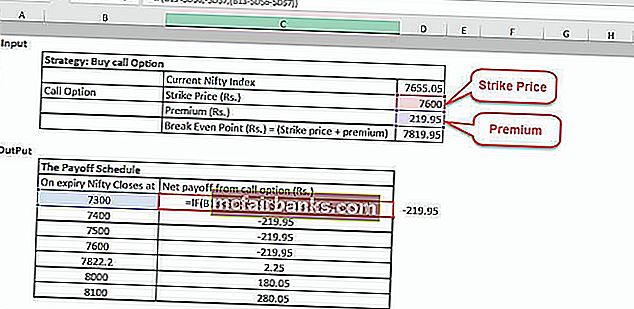

현재 Nifty 지수 가격 및 프리미엄 데이터를 얻은 후에는 Excel 스프레드 시트에서 다음과 같이 입력-출력 데이터를 계산할 수 있습니다.

- 위 이미지에서 볼 수 있듯이 현재 Nifty 지수, 행사 가격 및 프리미엄에 대한 데이터를 채웠습니다.

- 그런 다음 손익분기 점을 계산했습니다. 손익분기 점은 옵션 매수자가 옵션을 행사할 경우 손실을 피하기 위해 주식이 도달해야하는 가격에 지나지 않습니다.

- 콜 옵션의 경우 손익분기 점을 계산 한 방법은 다음과 같습니다.

손익분기 점 = 행사가 + 프리미엄

4 단계 : 보수 일정 만들기

다음으로, 우리는 보수 일정에 도달합니다. 이것은 기본적으로 특정 Nifty 지수에서 얼마나 많은 이익을 얻거나 얼마나 잃을 것인지를 알려줍니다. 옵션의 경우이를 행사할 의무가 없으므로 지불 한 보험료 금액으로 손실을 제한 할 수 있습니다.

스프레드 시트에는 다음 정보가 표시됩니다.

- Nifty의 다양한 종가

- 이 콜 옵션의 순수익입니다.

이 경우에 사용되는 공식 은 excel 의 IF 함수입니다 . 공식이 작동하는 방식은 다음과 같습니다.

- Nifty 종가가 행사 가격보다 낮 으면 옵션을 행사하지 않습니다. 따라서이 경우 지불 한 보험료 금액 (220) 만 잃게됩니다.

- 손익분기 점 이상에서 수익을 창출하기 시작합니다. 따라서이 경우 Nifty 종가는 행사 가격보다 높고, 귀하가 만드는 이익은 = (Nifty 종가-행사 가격-프리미엄)로 계산됩니다.

스프레드 시트에서 사용하려는 경우 위 이미지에 사용 된 공식을 확인할 수 있습니다.

각 전략에 대해 입력 데이터와 출력 데이터가 포함됩니다. 입력 데이터는 행사가, 현재 Nifty 지수, 프리미엄 및 손익분기 점입니다. 출력 데이터에는 보수 일정이 포함됩니다. 이것은 일반적으로 다른 Nifty 종가 가격으로 얼마나 벌거나 잃을 것인지에 대한 명확한 그림을 제공합니다.| 전략 : 매수 콜 옵션 거래 전략 | ||

| 현재 Nifty 인덱스 | 7655.05 | |

| 콜 옵션 | 행사 가격 (Rs.) | 7600 |

| 프리미엄 (Rs.) | 220 | |

| 손익분기 점 (Rs.) = (행사가 + 프리미엄) | 7820 | |

| The Payoff Schedule of this Options Trading Strategy | |

| On expiry Nifty Closes at | The net payoff from call option (Rs.) |

| 7300 | -220 |

| 7400 | -220 |

| 7500 | -220.00 |

| 7600 | -220.00 |

| 7820 | 0 |

| 8000 | 180 |

| 8100 | 280 |

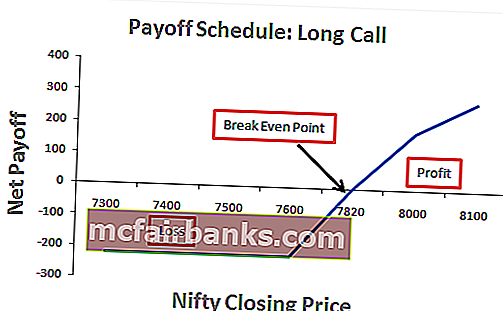

Long Call Strategy Analysis

- It limits the downside risk to the extent of the premium that you pay.

- But if there is a rise in Nifty then the potential return is unlimited.

- This is one of the option trading strategies that will offer you the simplest way to benefit.

And that is why it is the most common choice among first-time investors in Options.

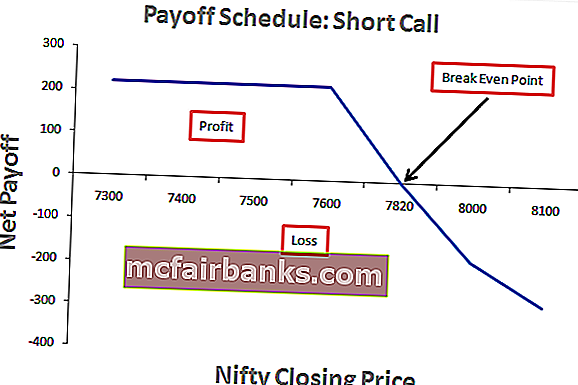

#2 Short Call Options Trading Strategy

- In the options trading strategy that we discussed above, we were hoping that the stock would rise in the future and hence we adopted a strategy of long call there.

- But the strategy of a short call is the opposite of that. When you expect the underlying stock to fall you adopt this strategy.

- An investor can sell Call options when he is very bearish about a stock/index and expects the prices to fall.

- This is a position that offers limited profit potential. An Investor can incur large losses if the underlying price starts increasing instead of decreasing.

- Though this strategy is easy to execute, it can be quite risky since the seller of the Call is exposed to unlimited risk.

| Best time to Use: | When you are very bearish on the stock or index. |

| Risk: | The risk here becomes Unlimited |

| Reward: | The reward is limited to the amount of premium |

| Breakeven: | Strike Price+ Premium |

Short Call Strategy Example

- Matt is bearish about Nifty and expects it to fall.

- Matt sells a Call option with a strike price of Rs. 7600 at a premium of Rs. 220, when the current Nifty is at 1.

- If the Nifty stays at 7600 or below, the Call option will not be exercised by the buyer of the Call and Matt can retain the entire premium of Rs.220.

Short Call Strategy Inputs

| Strategy: Sell call Option Trading Strategy | ||

| Current Nifty Index | 7655.1 | |

| Call Option | Strike Price (Rs.) | 7600 |

| Premium (Rs.) | 220 | |

| Break-Even Point (Rs.) = (Strike price + premium) | 7820 | |

Short Call Strategy Outputs

| The Payoff Schedule of this Options Trading Strategy | |

| On expiry, Nifty Closes at | The net payoff from call option (Rs.) |

| 7300 | 220 |

| 7400 | 220 |

| 7500 | 220 |

| 7600 | 220 |

| 7820 | 0 |

| 8000 | -180 |

| 8100 | -280 |

Short Call Strategy Analysis

- Use this strategy when you have a strong expectation that the price will certainly fall in the future.

- This is a risky strategy, as the stock prices rise, the short call loses money more quickly.

- This strategy is also called Short Naked Call since the investor does not own the underlying stock that he is shorting.

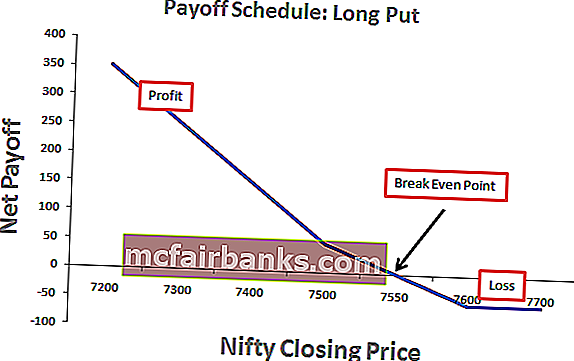

#3 Put Options Trading Strategy

- Long Put is different from Long Call. Here you must understand that buying a Put is the opposite of buying a Call.

- When you are bullish about the stock/index, you buy a Call. But when you are bearish, you may buy a Put option.

- A Put Option gives the buyer a right to sell the stock (to the Put seller) at a pre-specified price. He thereby limits his risk.

- Thus, the Long Pu there becomes a Bearish strategy. You as an investor can buy Put options to take advantage of a falling market.

| Best time to Use: | When the investor is bearish about the stock /index. |

| Risk: | Risk is limited to the amount of premium paid. |

| Reward: | Unlimited |

| Breakeven: | (Strike Price – Premium) |

Long Put Strategy Example

- Jacob is bearish on Nifty on 6th September, when the Nifty is at 1.

- He buys a Put option with a strike price Rs. 7600 at a premium of Rs. 50, expiring on 24th

- If Nifty goes below 7550 (7600-50), Jacob will make a profit on exercising the option.

- In case the Nifty rises above 7600, he can give up the option (it will expire worthlessly) with a maximum loss of the premium.

Long Put Strategy Input

| Strategy: Buy Put Option Trading Strategy | ||

| Current Nifty Index | 7655.1 | |

| Put Option | Strike Price (Rs.) | 7600 |

| Premium (Rs.) | 50 | |

| Break-Even Point (Rs.) = (Strike price – premium) | 7550 | |

Long Put Strategy Output

| The Payoff Schedule of this Options Trading Strategy | |

| On expiry, Nifty Closes at | The net payoff from call option (Rs.) |

| 7200 | 350 |

| 7300 | 250 |

| 7400 | 150 |

| 7500 | 50 |

| 7550 | 0 |

| 7600 | -50 |

| 7700 | -50 |

Long Put Strategy Analysis

- If you are bearish you can profit from the declining stock prices by buying Puts. You will be able to limit your risk to the amount of premium paid, but your profit potential remains unlimited.

This is one of the widely used options trading strategies when an investor is bearish.

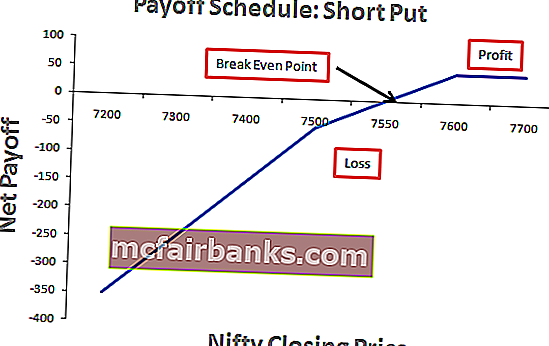

#4 Short Put Options Trading Strategy

- In the long Put option trading strategy, we saw when the investor is bearish on a stock he buys Put. But selling a Put is the opposite of buying a Put.

- An investor will generally sell the Put when he is Bullish about the stock. In this case, the investor expects the stock price to rise.

- When an investor sells a put, he earns a Premium (from the buyer of the Put). Here the investor has sold someone the right to sell him the stock at the strike price.

- If the stock price increases above the strike price, this strategy will make a profit for the seller since the buyer will not exercise the Put.

- But, if the stock price decreases below the strike price, more than the amount of the premium, the Put seller will start losing money. The potential loss is unlimited here.

| Best time to Use: | When the investor is very bullish on the stock or the index. |

| Risk: | Put Strike Price –Put Premium. |

| Reward: | It is limited to the amount of Premium. |

| Breakeven: | (Strike Price – Premium) |

Short Put Strategy Example

- Richard is bullish on Nifty when it is at 7703.6.

- Richard sells a Put option with a strike price of Rs. 7600 at a premium of Rs. 50, expiring on 24th

- If the Nifty index stays above 7600, he will gain the amount of premium as the Put buyer won’t exercise his option.

- In case the Nifty falls below 7600, Put buyer will exercise the option and Richard will start losing money.

- If the Nifty falls below 7550, which is the break-even point, Richard will lose the premium and more depending on the extent of the fall in Nifty.

Short Put Strategy Input

| Strategy: Sell Put Options Trading Strategy | ||

| Current Nifty Index | 7703.6 | |

| Put Option | Strike Price (Rs.) | 7600 |

| Premium (Rs.) | 50 | |

| Break-Even Point (Rs.) = (Strike price – premium) | 7550 | |

Short Put Strategy Output

| The Payoff Schedule of this Options Trading Strategy | |

| On expiry, Nifty Closes at | The net payoff from call option (Rs.) |

| 7200 | -350 |

| 7300 | -250 |

| 7400 | -150 |

| 7500 | -50 |

| 7550 | 0 |

| 7600 | 50 |

| 7700 | 50 |

Short Put Strategy Analysis

- Selling Puts can lead to regular income, but it should be done carefully since the potential losses can be significant.

- This strategy is an income-generating strategy.

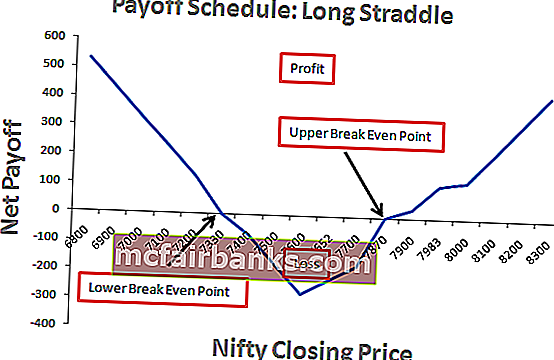

#5 Long Straddle Options Trading Strategy

- The long straddle strategy is also known as buy straddle or simply “straddle”. It is one of the neutral options trading strategies that involve simultaneously buying a put and a call of the same underlying stock.

- The strike price and expiration date are the same. By having long positions in both calls and put options, this strategy can achieve large profits no matter which way the underlying stock price heads.

- But the move has to be strong enough.

| Best time to Use: | When the investor thinks that the underlying stock/index will experience significant volatility in the near term. |

| Risk: | Limited to the initial premium paid. |

| Reward: | The reward here is Unlimited |

| Breakeven: | 1. Upper Breakeven Point = Strike Price of Long Call + Net Premium Paid.2. Lower Breakeven Point = Strike Price of Long Put – Net Premium Paid. |

Long Straddle Strategy Example

- Harrison goes to the NSE website.

- He fetches the data for the Current Nifty Index, Strike Price (Rs.), and Premium (Rs.).

- He then selects the index derivative. In instrument type Harrison selects index options, in symbol he selects nifty, the expiry date is 24th September, option type will be called, and Strike price is 7600.

- Call Premium paid is RS 220. Now in, option type he selects Put, the Strike Price is the same as above i.e. So Put premium paid is 50.

The data for our input table is as follows:

- The current nifty index is 7655.05

- The strike price is 7600

- Total premium paid is 220+50 which equals 270.

- Upper Breakeven point is calculated as 7600+270 which comes to 7870

- Lower Breakeven point is calculated as 7600-270 which comes to 7330

- We will assume on expiry Nifty Closes as on expiry Nifty Closes at 6800, 6900, 7000, 7100 and so on.

Long Straddle Strategy Inputs

| Strategy: Buy Put + Buy Call Options Trading Strategy | ||

| Current Nifty Index | 7655.05 | |

| Call and Put Option | Strike Price (Rs.) | 7600 |

| Call Premium (Rs.) | 220 | |

| Put Premium (Rs.) | 50 | |

| Total Premium (Rs) | 270 | |

| Break-Even Point (Rs.) | 7870 | |

| Break-Even Point (Rs.) | 7330 | |

Long Straddle Strategy Outputs

| The Payoff Schedule of this Options Trading Strategy | |||

| On expiry, Nifty Closes at | The net payoff from Put Purchased (Rs.) | The net payoff from call Purchased (Rs.) | Net Payoff (Rs.) |

| 6800 | 750 | -220 | 530 |

| 6900 | 650 | -220 | 430 |

| 7000 | 550 | -220 | 330 |

| 7100 | 450 | -220 | 230 |

| 7200 | 350 | -220 | 130 |

| 7330 | 220 | -220 | 0 |

| 7400 | 150 | -220 | -70 |

| 7500 | 50 | -220 | -170 |

| 7600 | -50 | -220 | -270 |

| 7652 | -50 | -168 | -218 |

| 7700 | -50 | -120 | -170 |

| 7870 | -50 | 50 | 0 |

| 7900 | -50 | 80 | 30 |

| 7983 | -50 | 163 | 113 |

| 8000 | -50 | 180 | 130 |

| 8100 | -50 | 280 | 230 |

| 8200 | -50 | 380 | 330 |

| 8300 | -50 | 480 | 430 |

Long Straddle Strategy Analysis

- If the price of the stock/index increases, the call is exercised while the put expires worthless and if the price of the stock/index decreases, the put is exercised, the call expires worthless.

- Either way, if the stock/index show volatility to cover the cost of the trade, profits are to be made.

- If the stock /index lies between your upper and lower break-even point you suffer losses to that extent.

- With Straddles, the investor is direction neutral.

- All that he is looking out for is the stock/index to break out exponentially in either direction.

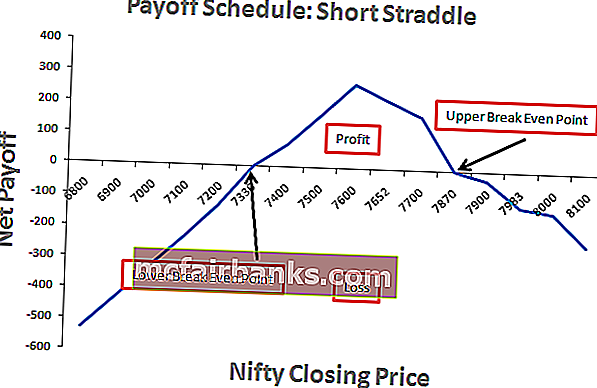

#6 Short Straddle Options Trading Strategy

- A Short Straddle is exactly the opposite of Long Straddle.

- An investor can adopt this strategy when he feels that the market will not show much movement. Thereby he sells a Call and a Put on the same stock/index for the same maturity and strike price.

- It creates a net income for the investor. If the stock/index does not move much in either direction, the investor retains the Premium as neither the Call nor the Put will be exercised.

| Best time to Use: | When the investor thinks that the underlying stock will experience very little volatility in the near term. |

| Risk: | Unlimited |

| Reward: | Limited to the premium received |

| Breakeven: | 1. Upper Breakeven Point = Strike Price of Short Call + Net Premium Received2. Lower Breakeven Point = Strike Price of Short Put – Net Premium Received |

Short Straddle Strategy Example

- Buffey goes to the NSE website and fetches the data for Current Nifty Index, Strike Price (Rs.), and Premium (Rs.).

- He then selects the index derivative. In instrument type he selects index options, in symbol he selects nifty, the expiry date is 24th September, option type will be called, and the Strike price is 7600.

- Call Premium paid is RS 220. Now in, option type he selects Put, the Strike Price is same as above i.e.

- So Put premium paid is 50.

Short Straddle Strategy Inputs

| Strategy: Sell Put + Sell Call Options Trading Strategy | ||

| Current Nifty Index | 7655 | |

| Call and Put Option | Strike Price (Rs.) | 7600 |

| Call Premium (Rs.) | 220 | |

| Put Premium (Rs.) | 50 | |

| Total Premium (Rs) | 270 | |

| Break-Even Point (Rs.) | 7870 | |

| Break-Even Point (Rs.) | 7330 | |

Short Straddle Strategy Outputs

| The Payoff Schedule of this Options Trading Strategy | |||

| On expiry Nifty Closes at | Net payoff from Put Sold (Rs.) | The net payoff from Call Sold (Rs.) | Net Payoff (Rs.) |

| 6800 | -750 | 220 | -530 |

| 6900 | -650 | 220 | -430 |

| 7000 | -550 | 220 | -330 |

| 7100 | -450 | 220 | -230 |

| 7200 | -350 | 220 | -130 |

| 7330 | -220 | 220 | 0 |

| 7400 | -150 | 220 | 70 |

| 7500 | -50 | 220 | 170 |

| 7600 | 50 | 220 | 270 |

| 7652 | 50 | 168 | 218 |

| 7700 | 50 | 120 | 170 |

| 7870 | 50 | -50 | 0 |

| 7900 | 50 | -80 | -30 |

| 7983 | 50 | -163 | -113 |

| 8000 | 50 | -180 | -130 |

| 8100 | 50 | -280 | -230 |

| 8200 | 50 | -380 | -330 |

| 8300 | 50 | -480 | -430 |

| 8300 | 50 | -480 | -430 |

Short Straddle Strategy Analysis

- If the stock moves up or down significantly, the investor’s losses can be significant.

- This is a risky strategy. It should be carefully adopted only when the expected volatility in the market is limited.

Conclusion

There are innumerable Options Trading Strategies available, but what will help you, in the long run, is “Being systematic and probability-minded”. No matter what strategy you use, it is essential that you have a good knowledge of the Market and your Goal.

The key here is to understand which of the options trading strategies suit you more.

So really, which of the options trading strategy suits you the most?

Useful Posts

This has been a guide to Options Trading Strategies. Here we discuss the six important strategies – #1: Long Call Strategy, #2: Short Call Strategy, #3: Long Put Strategy, #4: Short Put Strategy, #5: Long Straddle Strategy, and #6: Short Straddle Strategy. You can learn more about derivatives and trading from the following articles –

Original text

- Careers in Trading

- Proprietary Trading Meaning

- What is Trading Floor?

- Best Options Trading Books <